Cryptocurrency analyst Timothy Peterson has provided an in-depth assessment of what he describes as the current Bitcoin bear market, placing it in historical context and predicting a potential recovery within the next three months. Peterson noted in his statement that since 2015, Bitcoin has experienced ten bear markets, each defined by a 20% drop from its all-time high (ATH). While these declines are common (they occur roughly once a year), he noted that only four bear markets in the past have lasted longer than the current one: 2018, 2021, 2022, and 2024. Peterson also described the current downturn as relatively weak in magnitude. According to his analysis, Bitcoin’s underlying sentiment suggests that prices are unlikely to fall much below $50,000. He also noted that price momentum makes it difficult for Bitcoin to fall below $80,000, especially as central banks move toward looser monetary policies. Related News: Moment of Destiny in Ethereum: Bullish or Bearish? These Levels Are Critical Peterson, who predicted a timeline for recovery, suggested that the bear market would end within 90 days. He expects a potential price drop over the next 30 days, followed by a significant rally of 20-40% after April 15. He argued that this expected recovery could generate enough media attention to draw hesitant investors back into the market, pushing Bitcoin’s price even higher. *This is not investment advice. Continue Reading: Veteran Expert Says “We’re in a Bear Market” in Bitcoin, Reveals the Lowest Level BTC Price Will Fall to and the Bear Expiration Date

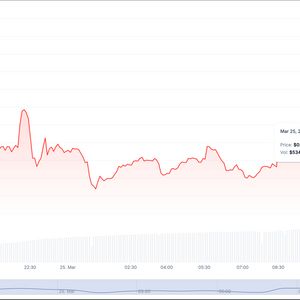

XRP Price Prediction For March 25

XRP Price Prediction For March 25