Interest in cryptocurrencies shows no signs of slowing down in Hong Kong as 25% of adults planning to invest, a new survey finds. A November 2024 survey by the Hong Kong University of Science and Technology found that a quarter of respondents plan to hold cryptocurrencies, up 6% from a poll conducted in September 2023, The Standard reports . The survey, which polled 5,863 adults over three weeks, also found that uncertainty still remains high. Across all three surveys, at least 40% of respondents indicated uncertainty in holding cryptocurrencies in the future, the HKUST research team stated. At the same time, despite the FTX collapse in November 2022, more respondents still expressed confidence in using regulated exchanges. The survey found that Hongkongers are significantly more willing to use crypto exchanges if they are regulated, with 20% more respondents saying they would feel safe depositing money into regulated platforms than unregulated ones. You might also like: Hong Kong SFC approves tokenized money market ETFs by HashKey, Bosera Bitcoin ( BTC ) remains the most favored cryptocurrecy, with more than 80% of respondents showing interest, an increase of 7% from the first survey. Meanwhile, interest in non-fungible tokens has declined, with a drop of 11% since the first poll. While more Hongkongers expressed their interest in buying cryptocurrencies, public understanding of tokenized money appears limited as 72% of respondents said they were unfamiliar with central bank digital currency, followed by 65% for e-HKD, 61% for stablecoins, and 81% for tokenized deposits, the survey showed. Hong Kong has made strides to advance itself into a crypto hub, namely through issuing licenses to crypto exchanges and made it possible for companies to issue tokenized investment products. In August 2024, the Hong Kong Monetary Authority launched a sandbox initiative dubbed “Project Ensemble Sandbox” that is designed to test and refine the use of tokenized money for interbank settlements and transactions involving tokenized assets. Read more: Fake ‘Hong Kong coin’ promoted by chief executive impersonator account

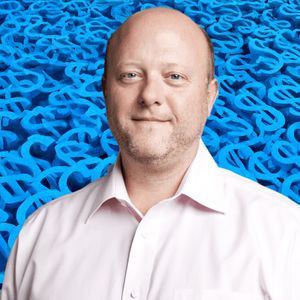

Stablecoin Issuer Circle Files for IPO

Stablecoin Issuer Circle Files for IPO Here’s what happened in crypto today

Here’s what happened in crypto today